Vine Ventures: Rethinking Venture Capital for a Novel Approach to Health & Wellness

Today we emerge from stealth with a proposal for reimagining how venture capital can foster the sustainable emergence of psychedelics. We also share some announcements of the actions that we’re taking towards that future.

Tim Ferris recently published some seminal posts (here and here) sharing his thoughtful remarks on the for-profit psychedelic medicine industry and raised questions around sustainability and inclusion. For some time we have agreed strongly with his take. We think it is now appropriate to put forth a venture capital solution that encourages the sustainable and equitable growth of this incredibly important field. We thank our close allies at North Star and others who have contributed to our strategy.

Nearly two years ago to the day, we began a journey with the thesis that psychedelics would emerge as an important part of the solution in solving the global mental health crisis, as well as offering opportunities for betterment of the well in a category I refer to generally as Conscious Health and Wellness. The psychedelics space will foster new companies and entrepreneurs, will innovate on the traditional models of capitalism, and will have a massive positive impact globally. But we believe that an open ecosystem lead by generics and naturals will allow a thousand flowers to bloom in the place of the long shadow of a psuedo-monopoly. Herein we share lessons learned from our journey so far, present some analysis, and chart a path forward as the space matures.

Starting from first principles

We began with a series of observations:

- The Mental Health Pandemic: Staggeringly, approximately 20% of the global population suffers from some form of mental health issues, a figure that was exacerbated dramatically by COVID-19. Mental health ailments present a debilitating shadow pandemic that has swept the globe. Meanwhile, overwhelmingly positive evidence of efficacy in a range of therapeutic indications has emerged from an academic renaissance in psychedelic research over the last decade. Psychedelics are certainly not a silver bullet to curing all mental health ailments, but they are clearly going to be a relevant part of a solution. For anyone who has particiapated in a plant-medicine ceremony, it is obvious that something special occurs when one combines thoughtful intention and mindfulness with the catalytic moment that these anceint compounds provide.

- The Allegories of Cannabis: The door that cannabis opened, both from the perspective of regulators’ and that of society at large, will allow other plant-psychoactive compounds to liberalize more quickly. While classical psychedelics present fundamentally different experiences and safety issues, there are a range of lessons to be learned from the development of the modern cannabis industry.

- Conscious Health and Wellness: We note the synergistic crossover between novel modalities of health and wellnesss. Whether micro-dosing by bio-hackers, the proliferation of breath-work with hot-cold therapies put forth by Inward or social movements like “California Sober,” which count participants in the tens of millions — psychedelic culture has made a compelling resurgence into modern zeitgeist.

- Mission Driven Entrepreneurs: When I started looking at the space, I noticed that some of the best work over many decades has been lead by non-profits like MAPS and Usona (please donate to both, if you can). As we’ve accompanied the growth in venture investment in psychedelics, we’ve come across so many mission-driven entrepreneurs that work tirelessly to build a future where people around the world can have access to psychedelic therapies in a safe, affordable, thoughtful manner.

Industry Analysis

We keep a detailed analysis of the emerging psychedelics industry to date, painstakingly cataloguing hundreds of companies, projects, non-profit organizations and community groups (starting with 283 in Q3-2019 and now more than 700). From this basis, we developed a mental map for how we look at the psychedelics value chain. Starting upstream in research and drug development and tracing down through production and all the way downstream into the interactions with the client/patient (Figure 1). Note: the below heuristic is not intended to be exhaustive, just a way to think about a value chain and touch points with end-consumers.

Some Observations from Our Analysis

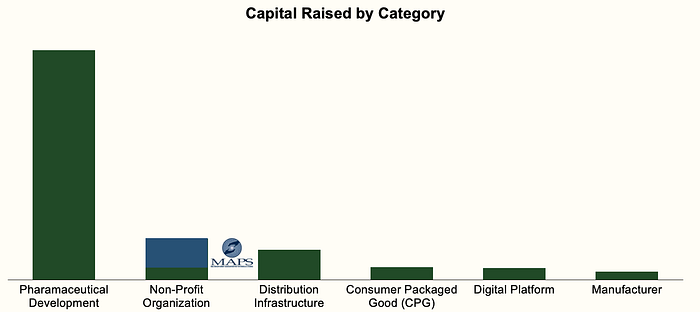

Value is accruing up the stack to drug development. The vast majority of the approximate 9 billion of current market capitalization of the space (adjusting for mega-pharmas, adjacent industries and other nuances) and nearly 4 billion in venture capital deployed has accrued towards pharma-patent development (Figure 2), mostly centered on synthetics and analogs.

Our subsequent deep-dive patent analysis, lead by our legal team and advisors, then demonstrated that a significant portion of ‘composition of matter’ patents and ‘for use’ patents may be attempts at patenting natural molecules that have existed for thousands of years and/or be a series of attempts to re-patent IP that was issued in the 70s and expired in the 90s.

The implication we draw here is that the proliferation of generics will likely come sooner than we think.

Hyper Medicalization: The emergence of psychedelics as a legitimately efficacious therapy for mental health has led to a dominant view towards what we call the “hyper-medicalization” of the space. Too many of our contemporaries are deploying time and capital towards an outcome whereby psychedelic therapies are mandated as strictly synthetic, prescription-restriained, with sessions accompanied only by an MD rather than a trained therapist, in a white-lab room in a hostpital, patent-controlled by large pharma, and costing thousands of dollars per dose in the course of multi-dose treatments! When I was pitched this vision by some prominant drug development firms and investors early on, my immediate response was “this sounds like dystopian future to me” and I was compelled to contribute my time and capital towards a better, more open-minded future of access to psychedelics.

Psychedelics should not be dominated by a few large pharma players and we work every day to avoid such a future.

Synthetics vs Naturals: Current means of synthetic production is generally bad for the environment. At Vine, we agree with Tim, that generics and GMP-quality naturally-cultivated psychedelics will form a compelling part of the demand profile and thusly, the value chain over time. However, we face a great problem in that natural stocks of plant-medicines are being dangerously over-stretched. Peyote and Iboga are now endangered species, while field reports indicate an increasingly scarce situation for the caapi vine (the active ingredient in Ayahuasca). As demand for these substances hits hockey-stick growth, we’ll have a major supply imbalance on our hands. In line with our thesis that use-cases for betterment of the well are coming faster than many believe, this sub-category of naturals production represents important opportunity for long-term value creation through innovation that venture investment can spur. Experiments like the raodao are interesting in this regard.

Strong Presence of Non-Profit Groups: Encouragingly, the second most successful category by capital raised thus far are non-profit organizations (Figure-3). We constantly meet industry leaders and entrepreneurs that share the desire to transcend traditional corporate models, redefine capitalism, and offer more holistic value-add to society through what they build. I predict that psychedelics will not only be a catalyst for novel forms of health and wellness, but we will also see new business models emerge that are more inclusive, lowering the gini-coefficient of value distribution across stakeholders.

Sometimes a novel industry can stack innovations on top of each other as entrepreneurs are not constrained by legacy systems.

Markets are racing ahead: It has been obvious to us since day 1 of this journey that the markets we fondly refer to internally as the “Cacao markets” — Canada, California, Colorado and Oregon, will be the leaders in adoption in psychedelics. There has been a Cambrian Explosion of players shifting into the space, with significant speculative activity in Canadian capital markets (Figure 4). We recognize that markets are leading indicators and thus it is natural that valuations can outsrip the practical realities in an emerging industry as it ascends up the hype cycle. However, we note concern over the flood of opportunism in the current market. We prefer to be patient capital and seek to build out scalable infrastructure to support billions of patients. We recognize the importance of novel funding mechanisms and reserve judgement, but we can report that our percentage of investible assets vs. opportunities in the space is lower than the vast majority of other categories in venture. This detail reminds us that we are likely still “pre vintage era” in the psychedelics space. We probably have yet to see the Coinbase or Twitter of the space emerge, but certainly we see raising stars such as Mindbloom, who sets to be the touch point with millions of patients through their platform.

Vine Reciprocity Pledge

In being inspired by so many mission driven entrepreneurs in the psychedelics space, we really wanted to “walk the talk” on being values-aligned at Vine. So today we announce the Vine Entrepreneur’s Reciprocity Pledge. Under the Pledge, Vine will commit fully half of GP Carry (not “a portion” or “some prooceeds”, but fully 50.0% of our profits) to be deployed into non-profit initiatives to drive the psychedelics space forward. This allows us to be prudent deployers of LP (i.e. outside investor’s) capital, while making a real commitment to advancing science and community from what we make as GPs. The projects the Pledge will fund will be a mix of indigenous development projects, academic research, community organizations, and social awareness initiatives around mental health, especially among underserved demographics. Further, the reciprocity capital will be directed exclusively by a round-table of our portfolio entrepreneurs and fund advisors, not the fund partners such as myself. This allows entrepreneurs who take capital from Vine to feel confident that a compelling percentage of the value they create will drive social projects at their discretion. The response to the Vine Reciprocity Trust has been overwhelming and we’ve already advanced donations to a variety of academic and community projects that we’ll discuss in a subsequent post.

Vine’s Approach

We look for special companies and entrepreneurs that meet a relatively simple criteria.:

1- high-integrity teams looking towards building a better more inclusive future;

2- teams that have deep technical competency in their field. (I’ll write a cheque to a bench of 5 scientists over a group 5 MBAs almost every single time);

3- products and services that occupy an important part of the value chain cited above and are defensible over time (due to durable execution, not necessarily purchased first-come-first-serve loosely defendable IP); and

4- businesses that can be scalable and touch a billion people’s lives.

An Example of What We Seek

I want to share an example of the kind of team we look for and announce our support. Vine lead the seed round into Psygen (one of more than 20 investments that we’ve made thus far), the premier Canadian manufacturer of psychedelic API including psilocybin, MDMA, DMT, and LSD. Psygen is emblematic of what we look for — an extraordinarily technical team executing on their lifelong dream to produce psychedelic compounds. As the only liscensed manufacturer in Canada for many years, Psygen has built out deep know-how around extraction, synthesis and GMP manufacturing of psychedelic compounds. Psygen stands to benefit irrespective of how the upstream patent race unfolds. Whether the industry is patent-controlled or whether generics flourish, they fit coherently into the value-chain. Their team is working to improve society meaningfully, lowering the cost of access to psychedelic therapies for patients across the world. This is the kind of team we fund.

We call on entrepreneurs and other investors who share our vision to join us on this psychedelic journey. Reach out and connect with us if you’re building the type of future that we’ve envisioned above. We’d be happy to collaborate and support you. I truly believe that when venture capital is applied correctly, it seeks to create and accrue value from making the world a much better place. There is a place for thoughtful values-aligned venture capital to contribute positively to the emerging Conscious Health and Wellness. This is why we built Vine.

-Ryan